All Categories

Featured

Table of Contents

With approved financier needs, investors are protected against from investing beyond their methods. If an inadequate investment decision is made, in theory an approved financier has better economic means to take in the losses. Unregistered personal safeties might have liquidity restrictions; such safety and securities might not be able to be offered for a duration of time.

Investors need to represent their financial resources truthfully to issuers of safety and securities. If a financier claims they are a recognized capitalist when they aren't, the financial firm can refuse to offer safety and securities to them. Recognizing what qualifies a capitalist as accredited is vital for establishing what kinds of safety and securities you can buy.

Respected Accredited Investor High Return Investments

Despite being recognized, all investors still need to perform their due persistance throughout the procedure of investing. Accredited investors can access our option of vetted investment chances.

With over $1.1 billion in securities marketed, the monitoring group at 1031 Crowdfunding has experience with a large range of financial investment structures. To access our complete offerings, register for a capitalist account.

PeerStreet's goal is to level the playing area and permit individuals to accessibility property debt as a possession class. As a result of regulative requirements, we are called for to follow the SEC's plans and enable just accredited investors on our platform. To much better educate our financiers about what this implies and why, read listed below to learn regarding these federal legislations.

Approved financiers and recognized financier systems are deemed much more sophisticated, efficient in taking on the threat that some protections present. This regulation likewise puts on entities, which consist of, banks, partnerships, firms, nonprofits and depends on. PeerStreet is taken into consideration a "exclusive placement" financial investment chance, unlike federal government bonds, and therefore based on somewhat different federal plans.

Accredited Investor Alternative Investment Deals

Those aiming to determine their net-worth, can use this explanatory table on the SEC's web site. These regulatory criteria have origins that go much back into the advancement of America's financial industry. The Stocks Act of 1933, just four years after the stock market accident of 1929 and in the thick of the Great Clinical depression, made specific stipulations concerning exactly how securities are marketed.

If you're seeking to construct and diversify your financial investment profile, take into consideration investments from business property to farmland, a glass of wine or art - accredited investor investment networks. As a certified investor, you have the chance to allocate a part of your profile to even more speculative possession courses that use diversification and the potential for high returns

See All 22 Items If you're a certified investor looking for brand-new possibilities, take into consideration the adhering to diversified investment. Yieldstreet concentrates on financial investments in actual estate, lawful negotiations, art, economic tools and delivery vessels. Yieldstreet is among the very best property spending applications for those interested in property and alternative financial investments that have a high total assets, with offerings for approved and nonaccredited investors.

9.6% annualized returns Investment-dependent; varieties from 0.00% for short-term note collection to 2.0%. Masterworks enables capitalists to possess fractional shares of art. Masterworks provides you the alternative to diversify your portfolio and purchase leading art work while potentially gaining earnings from 8% to 30% or more. Art has been a strong historical bush versus securities market volatility.

Top-Rated Accredited Investor Platforms

This chance includes all the advantages of other alt investments on the list, such as expanding your portfolio to shield against stock exchange volatility. Vinovest has shown profits of 10% to 13% annually in the past. 10.6% annualized returnsAnnual costs begin at 2.25% Arrived Homes offers recognized and nonaccredited capitalists the alternative to deal single-family citizens and trip rental residential or commercial properties with an ultra-low minimum investment of simply $100.

A certified financier has an unique status under financial regulation laws. Each nation defines certain needs and guidelines to qualify as a certified capitalist.

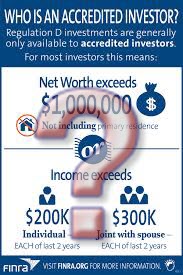

Recognized capitalists in the United state need to satisfy at the very least one requirement concerning their net worth or revenue, asset dimension, governance standing or expert experience. This demand includes high-net-worth people (HNWIs), brokers, depends on, banks and insurance provider. The U.S. Stocks and Exchange Compensation (SEC) specifies the term approved capitalist under Law D.

The concept of marking accredited capitalists is that these individuals are thought about monetarily innovative adequate to birth the risks. Sellers of non listed safeties may only market to certified financiers. Unregistered safety and securities are naturally riskier due to the fact that they aren't required to supply the regular disclosures of SEC registration. To come to be a recognized capitalist as a specific, you have to fulfill revenue or internet worth standards, such as an ordinary annual earnings over $200,000 or $300,000 with a spouse or cohabitant.

Renowned Accredited Investor Wealth-building Opportunities

A number of financial investment options for accredited investors, from crowdfunding and REITs to tough money financings. Here's what you can think about. Crowdfunding is an investment possibility growing in popularity in which a business, individual or task looks for to increase required funding online.

The role of the syndicator is to look and protect residential or commercial properties, handle them, and link investment agreements or pair financiers. This process simplifies property investment while using recognized investors exceptional investment possibilities. REITs pool and look after funds purchased various genuine estate residential properties or real-estate-related tasks such as home loans.

Table of Contents

Latest Posts

Buying Homes For Taxes Owed

Tax Liens Houses For Sale

Overbid Funds

More

Latest Posts

Buying Homes For Taxes Owed

Tax Liens Houses For Sale

Overbid Funds